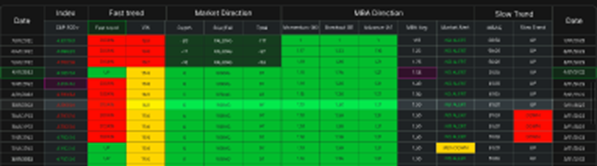

The Market Alert table shown below operates like a set of traffic lights. Green is go and red is danger, with yellow indicating caution.

Colors are used to provide an at-a-glance impression of the level of volatility in a market by displaying green, yellow and red both on the dials and in the market alert table. An all-green display is a rising market with falling volatility. All red rows in the market alert table or on the dials signal a market alert which means extreme volatility. A mix of green and yellow indicates a market in transition from low to high or high to low volatility. As the display moves from green to more yellow and then red, the market is falling into a period of higher volatility. As the display moves back to green the market volatility is falling as the market is rising.

If reading number is your preference, the M, B and A column numbers provide a deeper level of detail. The numbers indicate the direction of the market by rising or falling day over day. If, for instance, Advance is above 1 and climbing day over day, it is saying that more than half the stocks in the market have increased in price.

When Momentum is above 1 it is saying the overall market is bullish or the slope of the price chart is upward. The higher the number the faster the market is rising. When Breakout is above 1, it is saying more than half the stocks in the market are breaking to new highs in the medium term: the higher the number, the higher the number of stocks that are breaking out.

When M, B and A all move below 1 a market alert is possible. As these columns cross just below 1, they will turn yellow. This indicates a period of caution for traders, which might be followed by a market alert if the market continues to fall.

The numbers in the columns are best used to track trends and understand the changing mood of the market over time. By noticing the highs and lows a trader can learn to read when the market is overheated or oversold. Top and bottom turning points can be useful trade entry or exit points. We discuss all the market alert column statistics in detail in our eBook, Market Alert, which is available on the Market Alert Pro website. What we are asking you to appreciate in this article is that the mood of the market can be seen in the color display at a glance. Look for all green rows to indicate a rising market and all red rows to indicate a market alert. Market alerts may sound ominous but they offer buying opportunities and should thought of as time to consider buying the bottom of the market. We recommend looking back through the market alert table history to become familiar with the market periods where market alerts were signalled and when the subsequent market bottom occurred. Studying these patterns will assist with timing market entries going forward.