Revenue Per Share (RPS)

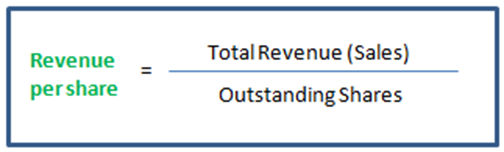

Revenue Per Share (RPS) is also known as Sales Per Share (SPS). RPS is calculated by dividing total revenue (i.e. sales) by the number of shares outstanding. Outstanding shares include the total number of shares held by regular shareholders, institutional investors, insiders and company officers.

Over the longer term the number of shares can vary a great deal. Hence, an investor needs to consider the RPS figure over time in light of any adjustments to outstanding shares. Total revenue is also subject to change. Therefore, a point-in-time RPS number will likely need to be compared to the trend in that metric over time. This is where RPS Growth Rate is valuable. RPS Growth is given as a percentage over 5 yrs. If the rate is positive, the company’s revenue is increasing, suggesting the company is growing – assuming the growth rate is above inflation.

Share Splits, Consolidations and Buybacks

RPS is affected by changes to the number of shares being used to divide the revenue figure. Companies will split shares (e.g. issue 2 shares for 1 and halve the price) to reduce the dollar value per share, or consolidate via a reverse split which has the opposite effect (e.g. issue 1 for 2 and double the price). These manipulations are done to adjust the liquidity of shares in the market and in the case of high dollar value shares, to make them more attractive to investors. This is a psychological adjustment as the actual value of an investment does not change. However, if a share is, for example, in excess of $2000 per share, some small dollar investors may be put off by the high value. The share value will also have an impact on options pricing and affordability. If a company delivers, for example, constant earnings growth, investors will demand more share liquidity in the open market. Share splits provide this liquidity.

Reducing the number of shares in the market place can be achieved by a company buying back its own shares. This practice tends to drive share prices higher and is a common place for companies looking to invest profits or cash reserves. However, if a company exhibits dwindling growth and is buying-back its own shares, it is possible the company is facing or preparing for delisting[1]. Because the number of shares outstanding can have a huge impact on earnings and RPS, one practice to overcome the impact of a share split or consolidation is to use the weighted average of shares outstanding. This simply averages the number of shares in the market for the reporting period at hand. Whatever the method, investors need to be cognizant of how the reported RPS was derived. Using the RPS growth over 5 years rate is one way to ascertain a more reliable RPS figure.

[1] https://www.investopedia.com/terms/o/outstandingshares.asp