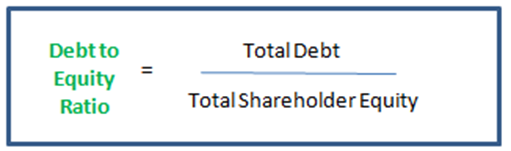

Businesses often need to raise capital to finance business operations. The Debt to Equity Ratio states how much financial leverage (debt) a company is using[1]. This figure is calculated by knowing the total liabilities of a company and dividing it by shareholders equity. Shareholders equity is calculated by subtracting total liabilities from total assets. This gives the company’s net worth. These figures are found on a company’s balance sheet. For example, if a company has $1mil in total assets and $500k in total liabilities, its net worth is $500k.

Equity is the amount paid to shareholders in the case where a company’s assets are sold off (liquidated) and its liabilities paid. However, shareholders are usually the last to be paid after creditors etc. Reviewing a company’s balance sheet can provide knowledge of shareholders equity and the company’s net worth. A high cash flow company will be better placed to service debt than a company in decline and with poor cash flow.

When a company uses debt to finance its operations its risk profile increases. While some debt can be good in that it allows for growth, too much debt will hinder the company, particularly if the cost of financing the debt grows near or beyond the company’s capacity to pay. The old saying, “you have to spend a dollar to make a dollar” is relevant here. The problem facing a company is to balance the use of debt against, for instance, where interest rates are likely to be in 1, 3 and 5 years time. Unless a fixed interest rate is negotiated, the cost of debt can become unmanageable. Debt may be necessary to enable a company to win a business contract. In this case, debt may be a good strategy to allow expansion. Here the company is expecting to grow. However, the debt to equity ratio needs to be considered in light of cash flow, revenue forecasts, market forecasts and capacity to service the debt. This is where the D/E ratio provides an assessment of the risk inherent in taking on debt. A D/E ratio around .5 to 1.5 is generally considered good. This means a company has $1.50 of debt for every $1.00 of equity. In dollar terms this could be said as: a company has $200,000 in assets and $80,000 in liabilities. Equity equals assets – liabilities = $120,000 of equity. Divide 120,000/80,000 gives a debt to equity ratio of 1.5.

Having a high D/E ratio combined with a strong positive cash flow can indicate a healthy company because the company is demonstrating it has the capacity to service a large debt. However, if the ratio gets too high the company may struggle to service its debt. A D/E of less than 2 is desirable. That said, there is no ideal situation because over time market conditions will alter. The cost of debt will change and market conditions will affect company cash flows and capacity to service debt. This suggests an investor will benefit from tracking a company’s D/E ratio and raw debt levels over time and consider the company’s capacity to service its debt from cash. A rising earnings growth rate and revenue per share over the mid to long term (3-5 yrs) would likely indicate a healthy company able to meet its debt costs.