There are two profit related reasons to sell a stock as a trader. The first is that the price has fallen since the trade was opened and the trader wants to minimise their loss via the use of a predetermined stop loss. A stop loss is a sell price below the trade entry price. It is often set at a price that restricts a trade loss to 1 or 2% of total capital used in the trading account. If a stop loss is triggered it suggests that the trader’s analysis was wrong and the expected rise in price has not occurred. Of course, long term growth investors seeking, for example, dividends and growth will apply a different analysis to buying and selling than traders who are seeking short term gains. Long term investors consider and analyse stocks in terms of multiple years of investment.

The second reason traders sell is that the stock price has risen and the trader wants to protect a profit by closing the trade. In this scenario, the trader may have decided to either sell while the price is rising, or, the price may have started to fall from a high and the trader wants to capture a profit before the price fall erodes a significant portion of any profit. Either way, this is a technical decision because price is the determining factor. Hence, the decision is based in price analysis. Often a trailing stop is used to execute the sell.

To support technical analysis, the efficient market hypothesis says that price perfectly reflects all information about a stock. Whether we believe this or not, price is price. Price is the amount a trader must pay for a stock and it is the amount a trader can receive when selling a stock. It is the value on the day. To aide in the decision making, price patterns can tell us something of the mindset of other traders. If a stock is forming new higher highs and new higher lows, the stock is said to be in an uptrend and we can say traders are supporting a higher price for the stock.

During an uptrend the buyers are in control and the price rises because the buyers are more committed to an upward price than sellers are to a lower price.

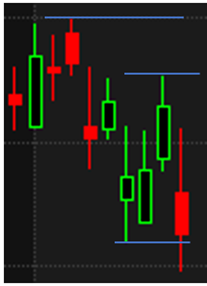

Higher highs and higher lows is a Dow thoery approach to analysis. In the chart (left), the stock has formed a new low and so the trend has changed to down. In this case the sellers are now in control. If the appearance of a downtrend is a (your) trade exit criteria, then this stock should be sold. Typically, the decission to sell a stock has more than one rule, but price closing below a prior low is a well recognised trade exit criteria.

Another possible exit rule is a profit target. Here the trader sets a percentage or dollar value target and sells as soon as the target is reached. This approach is a double edged sword though. One the one hand, a profit is locked in, but if the stock continues to rise in price, further profit has been cut off. At the same time, if a trader fails to close a losing trade, the perfect storm has ocurred. The trader has hung onto a losing trade while cutting off a winning trade by taking profits prematurely. This is common mistake made by traders. It is better to hold onto winning trades and close losing trades early.

At Market Alert Pro, the Market Alert table can be used to find market bottoms and tops. This allows a trader to better time market entries and exits. If a trader buys at the bottom of a bearish period and holds positions until the market recovers into a bullish period, trade exits can be taken when the market Alert table begins to show an overbought market. This is contrarian thinking. That is, a trader actively seeks out a bearsih period in order to secure stocks at a discounted price in anticipation of a market recovery and stock price rise.

Market Alert Pro offers many stock searches designed to find upward or downward trending stocks. These searches can be used in conjunction with the market alerts feature to find stocks at market lows or highs. Buying the dip is a well recognised trading strategy as is selling the top. By tracking the market mood in the market alert feature, buying and selling tops and bottoms is made easier.