The movement in the price of a financial instrument such as a stock or option is referred to as its volatility. Put simply, volatility is price movement over time, but the common usage refers to periods of high volatility when stock market prices are whip-sawing by larger than usual percentages. High volatility may be stressful, but without price movement no trader can make a profit. This means some volatility is needed otherwise traders can’t trade. Of course, if prices suddenly drop by large amounts, traders can experience significant losses, or at the very least, be affected by volatility anxiety.

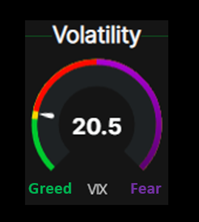

Volatility is caused by uncertainty which leads to fear and greed reactions. The Fear and Greed Index is one method of tracking market volatility. Notice that in the image right volatility is a single number with no history or indication of a trend over time.

In the example (right) the VIX Index is used to calculate the value. The VIX is calculated from averaging the weighted prices of out of the money puts and calls. Other calculations such as the CNN fear and greed index use stock price momentum, stock price strength, stock price breadth, put and call options, junk bond demand, the VIX and safe haven demand[1]. The CNN index puts a number on market volatility and reports it as being in a fear state or a greed state.

The point is, that traders react to market conditions by buying and selling financial products and these reactions can be represented on a simple dial such as the one above. Traders will react to any number of events such as terror attacks, the collapse of a large company, or a natural disaster to name a few. Volatility will spike when investor sentiment plunges. This is a fact of life for traders. How long the recovery takes and how deep the dip goes is related to the cause of the volatility spike. The Global Financial Crisis downturn took over a year to play out and the recovery took many years. Some say the effects are still being felt. The onset of the COVID-19 pandemic hit the US market in Feb 2020. However, the market started to recover just three weeks later and then boomed, albeit the Volatility Index (the VIX) has remained higher than the pre-COVID period. The VIX is now persistently over 20-25, whereas prior to Feb 2020 it was more like 12-14.

The psychological impact of a volatility spike can impact trading decisions quite dramatically mainly because uncertainty creeps in. “Where is the bottom”. “How far will the market fall”. “Is this the bottom?” These are all questions traders ask when a market plunges. It is all well and good to look at the fear and greed index and see it in the red. The problem is that by that time it can be too late to react. This is where the Market Alerts feature in Market Alert Pro can provide the information a trader needs to track volatility day by day to better understand where the market is headed. This information is designed to help overcome the fear and greed response to market volatility and do so much earlier than the VIX Index facilitates. Market Alerts are designed to allow a trader to see a period of high volatility as an opportunity as much as it is seen as a threat. The opportunity is to look for a market bottom and buy into good quality stocks that are beaten down in price. By exploring the Market Heat feature during a market alert, a trader can identify the best performing stocks during a bearish market. We discuss this technique in more detail in our free eBook Market Alert.

[1] https://money.cnn.com/investing/about-fear-greed-tool/index.html