There are many techniques available to rank stocks. These fall into technical and fundamental approaches. Technical analysis deals with price data as it is displayed on a stock chart while fundamental analysis looks into the financial statements and other financial reporting made available by companies. The P/E ratio (price to earnings ratio) and EPS (earnings per share) of stocks are common fundamental indicators. What we are interested in in this article, is ranking stocks and the sectors they reside in via their scores on EPS and P/E. P/E or the earnings multiple tells a trader how much other traders are prepared to pay for $1 of earnings. At a P/E of 15, investors are willing to pay $15 for each $1 of earnings. The market average for P/E is around 15 to 20, but stocks can have wildly varying P/E scores because of the math involved. It is calculated by dividing the price of a stock by its earnings or EPS. Therefore, if earnings are low and price is high, P/E will be high. For instance, a stock at $10 with an EPS of .10c has a P/E of 100 while a $1.00 stock with an EPS of .10c has a P/E of 10. Based on this, an investor needs to assess the EPS and Stock price carefully before drawing conclusions about a P/E level. That said, P/E is a widely accepted means to compare stocks and/or sectors of a market.

A stock sector is a basket of stocks that have a similar activity such as utilities or basic materials and so on. If we average the P/E and EPS of the 11 sectors used in most exchanges, we can then compare sector performance. Once the sectors are ranked, the stocks within the sectors can also be ranked based using the individual stock’s P/E and EPS.

In this analysis it is useful to look at forward forecasts out to at least three years. If this is not available, then the current published scores are sufficient.

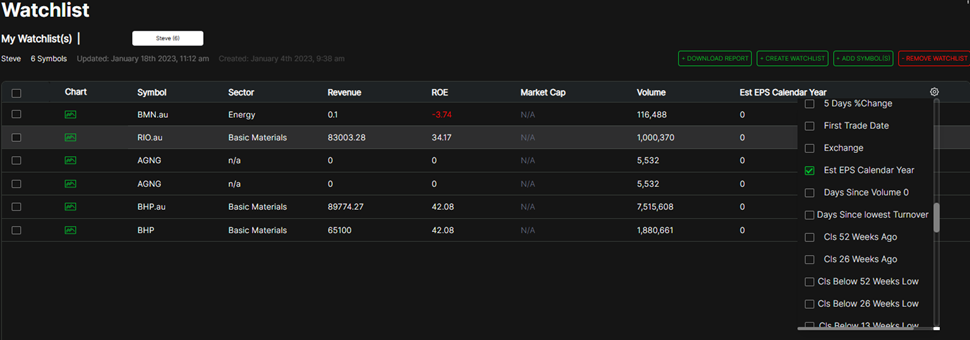

A sector summary and stock distribution is available on the Market Alert Pro dashboard. Pie charts provide a quick view of the distribution of stocks across sectors while the table data shows sector performance across the last three years. Individual stock EPS and P/E can be found in the Market Alert Pro Watchlist feature. When selecting stocks for watchlist inclusion we recommend reviewing the Watchlist settings button to add P/E, EPS and Estimated EPS columns to your analysis.

Sectors with high P/E and EPS scores are demonstrating higher growth. Stocks with Estimated EPS higher than current EPS are expected to grow in price. If a stock’s price is in a healthy trend and it is showing positive P/E and EPS it is more likely to perform than a stock with less favourable metrics.

There is no right or wrong way to short list stocks for investment purposes. The technique discussed here is one approach and it should be adopted with other analysis including a technical review of each stocks price performance.

In addition, a review of the wider market performance should be added to an investors decision making process.

If you are unsure about P/E, EPS or any other means of ranking stocks, we recommend you read about these metrics as there is a wealth of knowledge freely available.