Return on Investment

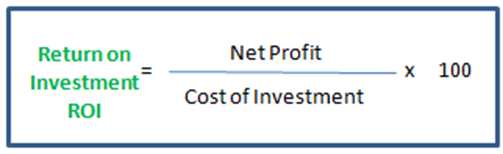

Return on Investment (ROI) measures the ratio of profit made against the original cost of an investment, while Return on Equity (ROE) measures the ratio of annual income to shareholders’ equity. To calculate ROI we need to know the cost of the original investment and the net income derived from the investment. We then calculate the increase in the profit and divide it by the original investment value and multiply by 100.

So an investment that makes $10 profit from an original $100 cost is calculated as (10/100)*100 =10% ROI. This of course opens up a can of worms in that the cost of the original investment will be open to interpretation. There is also the issue of the time frame we are considering. For instance, if we make a 35% return over one year vs over five years, there is a significant time value of money difference to consider. I.e. 35% over 1 year is 35% pa, but 35% over five years is 7% pa.

To deal with the time value issue, ROI is typically reported as an annual percentage which means it is based on company profits for the year vs costs for that year. Even so, this may not provide an accurate picture of the longer term return. An investor will likely need to look at several years of returns to accurately gauge the company’s ROI over time. The bottom line is that ROI is a simple calculation that assumes accounting practices have been diligent and standardised. By way of interpretation, we can say that ROI is a way to know the benefit an investor will receive in relation to the cost of an investment. The higher the ROI ratio the higher the benefit received. For a prospective buyer of a share, the figures provide an insight into the past performance of the company and perhaps give an indication of what to expect going forward.

ROE on the other hand, divides net annual income by shareholders equity. Shareholders equity being the total of issued share capital and retained earnings. ROE shows a company’s capacity to turn shares owned by investors into profits[1]. ROE is a bottom line gauge of a company’s performance in terms of creating profits for shareholders. A comparison of a company’s ROE to other companies in the same industry provides a means to rank company performance against other companies. From an investor’s point of view, the ROE should be higher than what is available in a low risk investment such as a fixed term bank deposit or similar investment. The downside of ROE is that it can be affected by share buybacks which inflate the ROE because after a buyback less shares are held by investors, and, as with ROI, ROE is not time sensitive. As with all fundamental indicators, an investor needs to understand how ROI and ROE have been calculated (annual, quarterly etc or is the reported figure taken since the investment started).

Regardless of the pro’s and con’s of ROI and ROE they are commonly used and relied upon fundamental analysis metrics.

[1] https://corporatefinanceinstitute.com/resources/knowledge/finance/what-is-return-on-equity-roe/