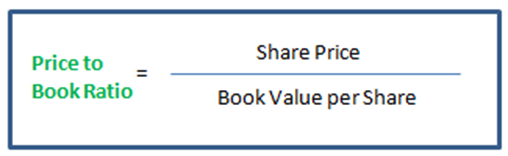

Price to Book Ratio measures stock price or in other words the market price of a share against the book value of the company. It is calculated by dividing a company’s stock price by its book value: book value being the value of a company’s assets on its balance sheet. If its P/B ratio is less than 1, a company is said to be undervalued. I.e. the stock price is low compared to the book value of the stock. However, a very low P/B can also mean there is a problem with the company.

A very low P/B can mean a company is earning low or negative return on its assets (ROA). Also important, is that P/B is most reliable when used to compare two companies with similar assets and liabilities, i.e. two companies in the same sector[1]. Two banks for instance. The bottom line is that investors use P/B to decide if a company’s share price is in line with its underlying balance of assets and liabilities – its book value. The ideal situation is to find stocks with a high P/B and a high Return on Equity (ROE).

At the same time, we need to be aware that asset values can be overstated and this will push the P/B ratio down. If shareholders become aware of overstated asset values, they may move away from a company thus causing its share price to fall. If this happens, investors still holding shares can be left with negative returns. In this circumstance, a company might restructure its management and/or business operations to recapture investor confidence. This could then lead to a stock price rise as investors approve of the changes. The key point is that value-investors use a low P/B ratio to identify undervalued stocks. That is, stocks prices that are below the book value of the company. When the P/B ratio is high, above 3 or 4 for instance, a stock is said to be overpriced compared to the value of its assets.

To increase the reliability of the P/B ratio as an indicator of future price movements, Return on Equity (ROE) can be used. This is because ROE measures a company’s profit. However, ROE growth over time is more likely to indicate price action than a point in time figure. ROE and P/B growing at the same time is ideal[1]. The rule of thumb is: a high P/B ratio with a low ROE usually means a stock is overvalued, while a low P/B ratio with a high ROE indicates an undervalued stock. Ideally, an investor wants to find high P/B and high ROE together. Using ROE and P/B together increases the reliability of the P/B ratio. However, P/B does have some shortcomings. P/B does not detect high levels of debt or non-operating financial issues that affect the real value of a company. In addition, companies can manipulate cash levels to increase or decrease their book value.

Key Points:

- P/B compares share price to underlying book value.

- ROE adds a measure of reliability to P/B ratio

- ROE and P/B moving higher together is ideal.

[1] https://www.investopedia.com/ask/answers/010915/does-high-price-book-ratio-correspond-high-roe.asp

[1] https://www.investopedia.com/investing/using-price-to-book-ratio-evaluate-companies/