PEG ratio is the stock’s price divided by the growth rate of its earnings over a known period of, for example, one, three or five years. It is important to know that the PEG ratio differs from the P/E (Price to Earnings) ratio in that P/E establishes the value of a stock compared to that stocks earnings, while PEG adds the dimension of the stocks future growth prospects.

The assumption is that the growth rate curve (when charted) is likely to continue to trend in the same direction or at the same rate as it has in the recent past. This assumption allows the PEG ratio to provide an insight into the expected earnings growth over a period into the future.[1] How long that period is, is a matter of trader discretion. The longer the forecast, the less accurate it is likely to be. Nevertheless, PEG provides a measure of whether a stock is over or undervalued.

The principle underlying PEG is the higher the expected growth rate, the more valuable the stock becomes. If a company has a high growth rate, it is likely that investors will pay a higher share price. This means growth stocks may be more attractive than value stocks, but an investor has to make a decision as to how much premium they are willing to pay for potential growth.

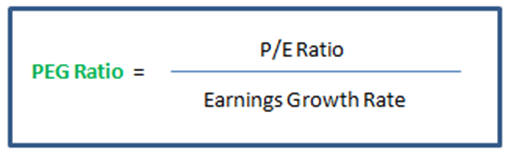

To calculate the PEG, divide the P/E ratio by the expected growth rate. This obviously raises the problem that future growth rate is an estimate. It is usually based on growth history, but as we all know, past performance is no guarantee of future success. Nevertheless, PEG is seen as a better indicator of value than P/E because it includes the growth component and a trader usually has access to fairly recent growth statistics that are known and published. Albeit, these can and do change in the near future term.

There are various methods for calculating the PEG ratio. Some data vendors calculate it using forward estimates of growth and earnings, while others use average estimates for the current fiscal year. Once again, traders may find themselves in the position of needing to understand how fundamentals have been calculated before deciding which figure is to be relied upon. No approach is right or wrong, unless of course, accounting standards have been abused or the data has been designed to mislead. The use of a PEG ratio is typically to establish if a company shows the prospect of future growth.

As is the case with any fundamental data, obtaining reliable, up to date and accurate numbers can be either expensive or simply difficult: the latter caused mainly by infrequent reporting. There are more difficulties with using PEG. A trader needs to know what growth rate method has been used. Is the growth rate forward looking or historical for instance? Is the stock cyclical? If so, at what point of the cycle is the PEG reported? The issues are many. An investor using PEG or any fundamental indicator for that matter, needs a deep and complete understanding of how the indicator is calculated before relying on it. That is not to say the indicator is unreliable. It is more a matter of understanding the message the indicator is providing and how to turn that into a trade decision.

[1] https://www.forbes.com/advisor/investing/peg-ratio/