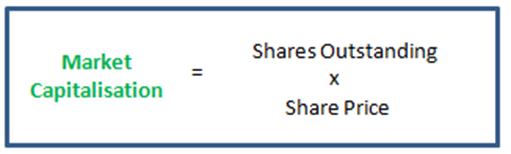

Market cap refers to the total value of all the shares issued by a company. For example a company with 50 million shares outstanding and a share price of $1, has a market cap of $50mil (50m x $1 = $50mil). This figure is important because it ranks a stock as large-cap, mid-cap or small-cap.

On the S&P 500 and the Dow Jones Industrial Average, the free float method has been adopted for calculating the number of shares outstanding. This method only includes shares that are available to the general public. Hence, the figure can be quite volatile because it changes in step with changes in the share price. The payment of dividends for example can affect the share price overnight when the share goes ex-divided, as will the supply of shares available to trade. Hence the Market Capitalisation figure can vary greatly over short time frames: albeit blue chip stock prices are thought to be more stable than speculative stock’s prices.

Large companies usually have a market value of $10 billion or more. These are usually known as blue-chip companies and so have a strong reputation for quality goods and services as well as the paying of dividends regularly. Mid-cap companies have a market value of $2bil to $10bil. These companies tend to operate in established industries expected to experience high growth. Small-cap companies range in value from $300mil to $2bil. These companies have more volatile share prices and often have limited resources and are more susceptible to market forces. However, they can also experience very high growth making them attractive to more speculative and aggressive, growth investors.

Market cap can be impacted by the exercise of warrants which alter the number of shares available to the public investor. These warrants are usually traded below the market price of a share and so tend to pull the share price down. Note that when a warrant is exercised, the shares applicable to the warrant are received directly from the company. No public shares change hands. Hence, the number of available shares increases. Note also, that a warrant is purchased by an investor where the purchase price of the stock is set in the warrant. An investor would only do this if they believe the value of the share will rise in the future. Hence, the exercise of the warrant would mean the investor profits from obtaining the shares at less than market price.

Supply and demand forces also apply to share trading. If supply is restricted share prices tend to be more volatile because there is more competition for the small supply. This affects market capitalisation more for small-caps than it does for large-caps. This usually mean low priced, small cap shares are affected more by volatility when trading news is published. Holding small cap stocks in a portfolio requires attention to the risk profile of the companies being considered. Smaller trade size is one strategy when trading speculative or low cap stocks. Larger cap stocks often (but not always) pay a dividend. The task for the trader is to decide on the merits of capital growth over dividend yield. Small cap stocks may provide faster price movement, but are less likely to pay a dividend. Also, small cap stocks can and do move very quickly which means capturing profits requires close attention to price movements.