Free Cash Flow or FCF is a measure of how effectively a company creates money from its core business activities after allowing for capital expenditures such as equipment and plant or the cost of land and purchased premises. If a business is to grow, it has to invest capital into the business. FCF helps to understand how much cash a company has left after accounting for the cost of its investment.

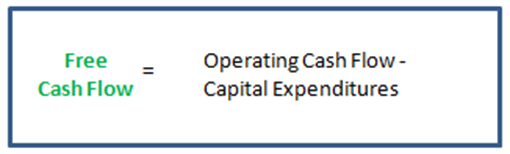

Once the FCF is known, investors are in a better position to know whether the company can repay its creditors, issue dividends, or buy back shares. By observing FCF an investor can understand the impact of capital expenditure on a company’s financial health. FCF is equal to operating cash flow minus capital expenditures. Operating cash flow being a company’s capital created from usual business activities but excluding expenses or long term expenditures. In other words, operating cash flow can be thought of as a gross figure while FCF is a net figure for cash (capital) generated by a company.

The higher a company’s free cash flow the more likely it is to be able to repay debt, buy back shares or pay dividends. However, care must be taken to consider the FCF figure in light of a company’s size and long term expenditures. That said, FCF provides a strong indication of the intrinsic value of a share. To the extent that a company’s reported earnings can be investigated and verified, FCF provides an accurate and reliable picture of a company’s financial health. On the downside, FCF is vulnerable to poorly judged or misleading growth figures in company reports and relies heavily on transparent and accurate reporting of financial statements[1]. Also, any forward estimates made by an investor using FCF are subject to market volatility going forward. On this point, it is worth noting that FCF is a short term indicator. This is because much can change in a year of company operations. A strong FCF today can deteriorate over the long term. This indicator is not reliable for long term (2+ years) investing strategies.

FCF should probably be in the fundamentals arsenal of most investors because it is simple, reliable and helps to eliminate uncertainty. While it is less useful for the long term buy and hold investor, it certainly assists in the initial investment decision making process. The major advantage of FCF is that it is not a guesstimate. It is derived from observable financial statements which to a large extent can be verified. FCF does not rely on an estimate of the share value which will be affected by the market sentiment at the time of the estimate.

Free cash flow is indicative of a company’s efficiency and liquidity. Strong FCF year on year suggests good management and processes. However, high FCF can also mean a company is not investing enough or as much as it could, into growth activities. As is the case with any indicator, there are pro’s and con’s to consider. The investor’s task is to arrive at a suite of indicators that are understood so that they are “fit for purpose”. That is, it is up to the investor to understand what each chosen indicator is saying.