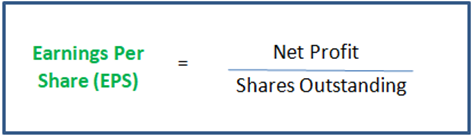

Earnings Per Share is a go-to metric when traders and investors consider company fundamentals. EPS is earnings per share, and as the name suggests, the EPS for any stock is derived by dividing the company’s earnings by the number of shares outstanding. However, despite its popularity, there is an inherent problem with EPS. Traders regularly compare the EPS of one company to that of another company.

The problem with this is that the number of shares the companies have outstanding is likely to be vastly different. At the same time, there are many different accounting strategies used to arrive at a company’s earnings. Hence, a direct comparison between different company’s using EPS is problematic. For instance, EPS can be calculated with or without extraordinary items, with or without normalization and with or without accounting for diluted shares outstanding. To add to the mix, there is quarterly, bi-annual and annual reporting of EPS. An investor needs to look into these variables before comparing the EPS of different companies.

Unless the source of the EPS figure states the calculation method, it is going to be difficult to know just what we are looking at. So what is the answer to all of the above? How does a trader find a useful EPS and how should it be used. The first part of the answer is to understand that the more important figure than the EPS itself is the trend of the EPS over time, expressed as EPS Growth Percent. Also, regardless of the magnitude of the EPS figure, an upward trending EPS over a three or five year period is more informative than a snap shot in time. A steadily rising EPS over time is a sign of a healthy company. The second part of the answer is to avoid comparing the raw EPS of one company to that of another. Unless the number of shares in the market place is the same for both companies, a comparison of raw EPS figures is quite meaningless[1].

For example, if company A has 1,000,000 shares outstanding and earnings of $1,000,000. Its EPS is 1.00. If Company B has 1,000 shares outstanding and earnings of $1,000. Its EPS is also 1. Which company is the larger and more mature? From the EPS there is no way to tell. The EPS of a company can be very high simply because it has few shares on issue. The more shares on issues with the same earnings, the lower the EPS will be. Does raw EPS alone provide a good measure of the company’s performance? No, we need to consider a suite of fundamentals in order to paint an accurate picture of a company’s performance. A review of the most popular fundamental indicators creates a list including ROE or return on equity, ROI or return on investment, book value per share and revenue per share. Other popular fundamentals include P/E ratio, dividend yield, free cash flow and projected earnings growth or PEG. We will look at these in other posts.

The key take-away here is that one metric used in isolation is not as reliable as a suite of indicators. That said, having a good working knowledge of how each indicator is calculated provides a higher level of confidence in the decision-making process.

In the diagram above EPS is calculated by dividing net profit by shares outstanding. What is the net profit of a company? Typically, a trader must rely on company reports but often these reports are quite old by the time a trade is considered. Annual reports can obviously be up to a year old by the time a trader needs to rely on the figures stated in them. In addition, accounting is a complex and nebulous task. While there are rules and standards, there is always an element of opinion and judgement involved in the accounting process. Even if the accounting process is precise and accurate, the accountant has to rely on figures provided by the company and most traders should be aware of media stories of company reporting being, at times, questionable or overly optimistic. At the very least forward estimates are just that, an estimate. This is perhaps why reporting is seen as being more reliable for top tier or blue-chip companies. Their high profile and reputation provides some assurance of integrity. Even if the intention of a company is robust, mistakes can occur. More than this, figures relied upon to compile company reports can and do go out of date in a very short time. Economic circumstances can suddenly change or the unforeseen loss of a key contract can make reported figures obsolete.

Relying on old data may be problematic, but for the fundamental analyst this is the challenge and the data is what the trader has to work with. It is no different in principle to a technical analyst relying on back test results to forecast future trading outcomes. Both have their pro’s and con’s. The most important aspect is to be aware of how much reliance to put on data.

[1] The Folly of Making EPS Comparisons Across Companies. Kelly and Hora, Journal of College Teaching & Learning Feb 2008, Vol , Number 2.