Dividend

A dividend is an amount paid to company shareholders. It is based on the company’s profits and is allocated to each shareholder as so many cents per share owned. It is one way a company can return profits to investors. The dividend rate is determined by company profits and the amount of cash the company wants to retain. Not all companies pay a dividend.

Typically, dividends are paid by companies with large cash flows where the company does not need to reinvest that cash into the company’s operations. Dividends are expressed in dollars and/or cents. Any investor who holds shares prior to the ex-dividend date and holds the shares until the market open after the ex-dividend date, qualifies to receive the dividend.

Dividend yield

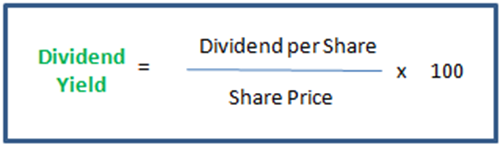

Dividend yield is reported as a percentage. Dividend yield is calculated as a ratio of a company’s dividend compared to its share price. Dividends can be paid quarterly, half yearly or annually or even monthly. A company can choose to pay a dividend in shares or other assets. Non-share dividends will happen when a company wants to retain cash for operations, but still provide a return to investors. Dividend yield is a useful metric as it allows the profit per share to be compared across companies with different share prices. Dividend yield is calculated as the dividend dollar amount divided by the share price and multiplied by 100. E.g. share price = 1.00 divided by .10c dividend = 10% yield. The yield will rise if the share price falls and fall if the share price rises. This means that a strong yield percentage may mean the share price has fallen substantially rather than the raw dividend rate rising. Investors ranking companies on dividend yield need to be aware of the trend in a share price to determine if a high yield is a positive indicator or not.

Investors need to decide if the potential dividend yield to be acquired by purchasing shares outweighs a possible future downward change in the price of the share. Alternatively, an investor may simply want to park funds in a share that pays a strong dividend and collect the dividend year after year. In such a strategy the investor is not concerned about share price cycles. However, if the funds are needed sooner than expected and the share price has fallen, a capital loss may result which is greater than the dividends received since the investment commenced. In some countries, such as Australia, some companies pre-pay the tax on dividends. This is referred to as Franking and fully franked (100% tax paid) dividend stocks are an attractive investment. However, fluctuations in the share price still affect the capital value of the investment. As is often the case, looking at the long term trend of dividend payments is more useful than spot checking one payment. If a company has been steadily increasing its dividend payments and this trend has a long history, the company is doing something right. It is creating profits from which to pay increasing dividends. On the flip side, if a company is paying large dividends, a downturn in the market may force it to reduce dividends or even not pay at all. There are no guarantees that a company will pay its next dividend. Then there is inflation. If an investor is collecting dividends from a sum of money parked in a blue-chip stock, the dividend rate needs to be above inflation.